flow through entity llc

For further questions please contact the Business Taxes Division. A business owned and operated by a single individual.

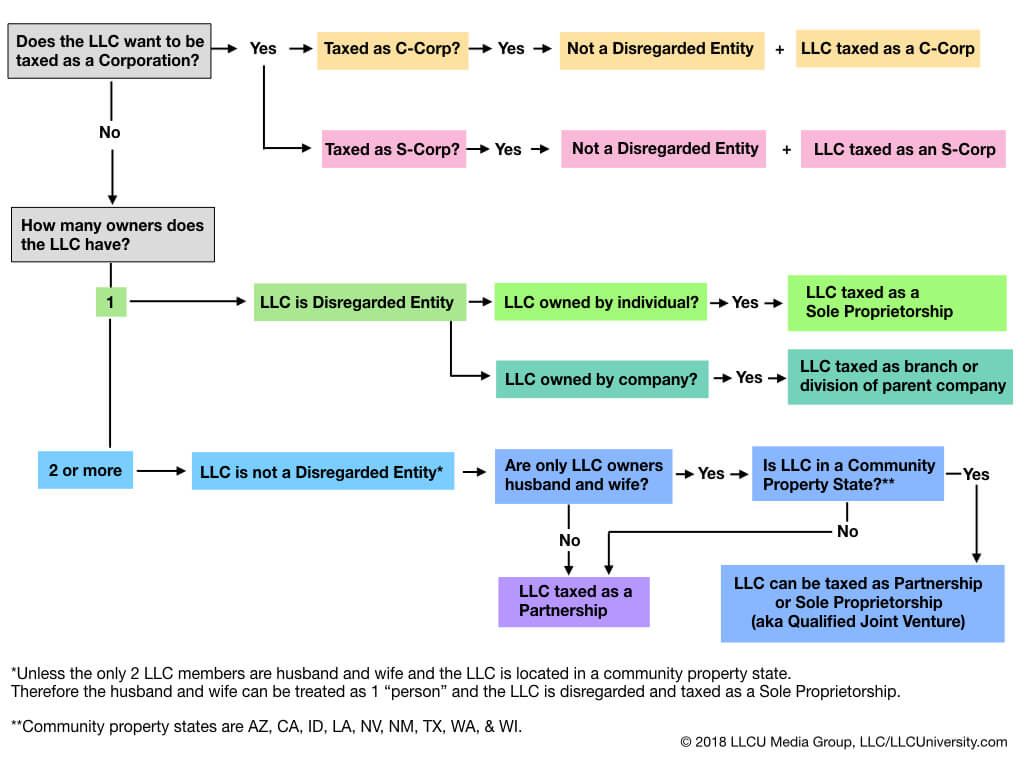

What Is A Disregarded Entity Llc Llc University

An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a.

. Where a single member LLC. Tax purposes and accordingly its operations are reported on the members individual tax return. While the default tax treatment for an LLC is pass-through taxation owners may elect to be taxed as C corporations.

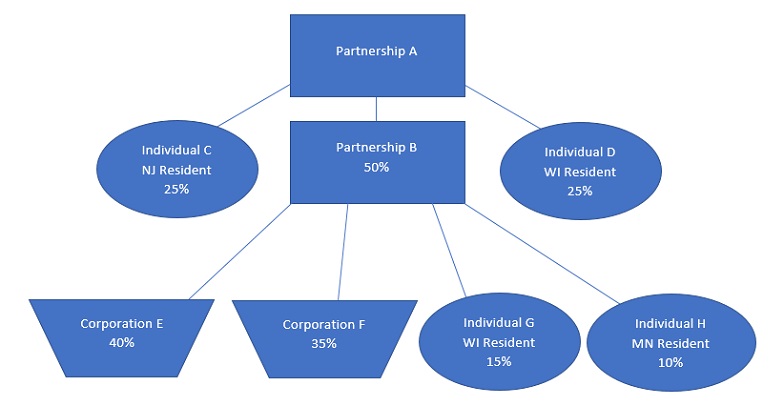

Structuring the Flow-Through Entity. An LLC can choose between different tax treatments. This guidance is expected to be published in early January 2022 and will be posted to the Departments website.

3 Can a foreigner be a partner in an LLC. In a pass-through entity also knows as a flow-through entity business income isnt taxed at the company level. A flow-through entity is also called a pass-through entity.

With that said the LLC isnt a separate tax entity. Therefore LLC owners cant be held personally liable for the debts and obligations of the business. LLC Income Tax Overview.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence. 4 Can a non US citizen open an LLC.

As a result only these individualsand not the entity itselfare taxed on the revenues. Instead that income passes through or flows through to the owners and is. 5 Who qualifies for 20.

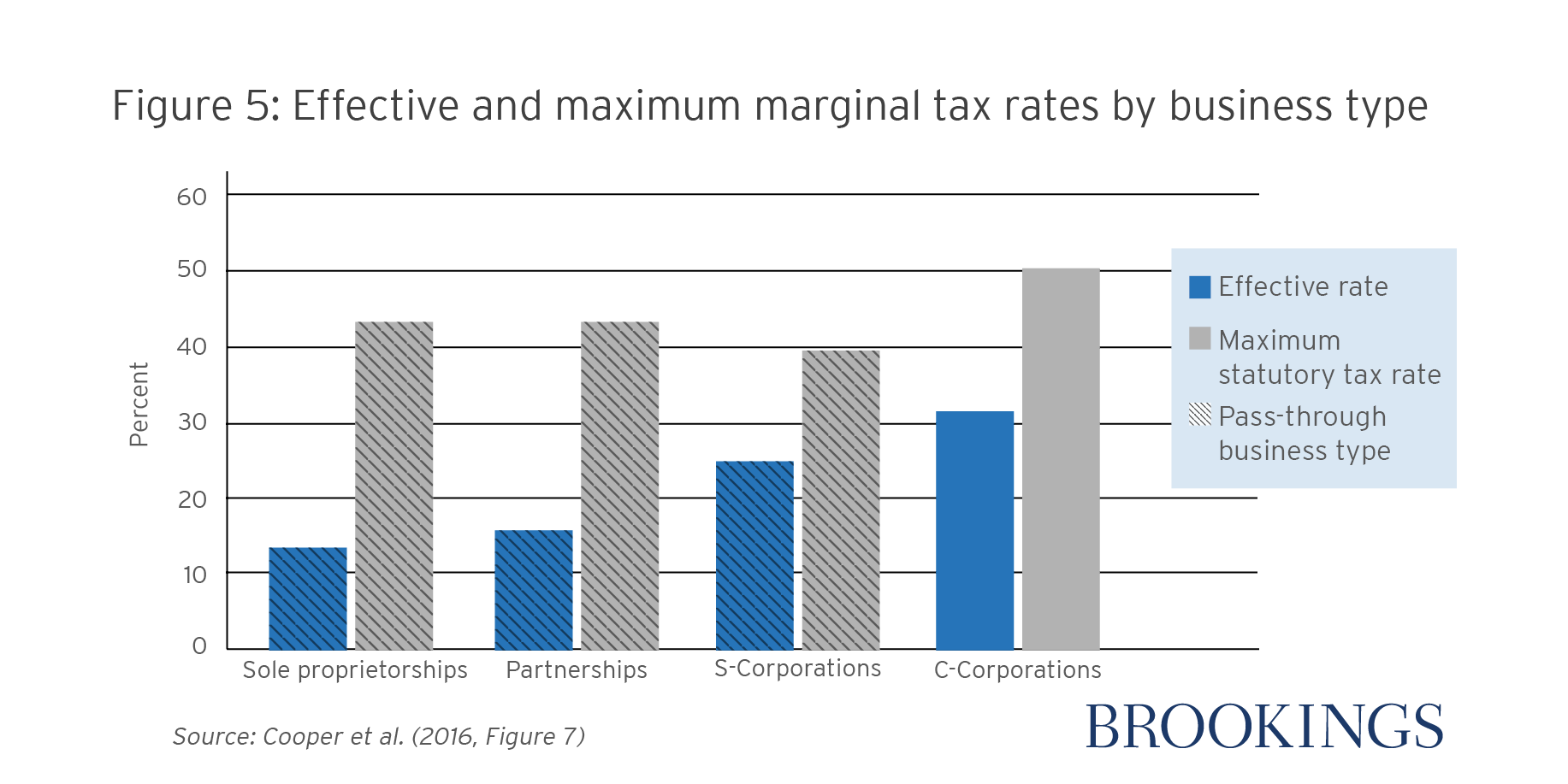

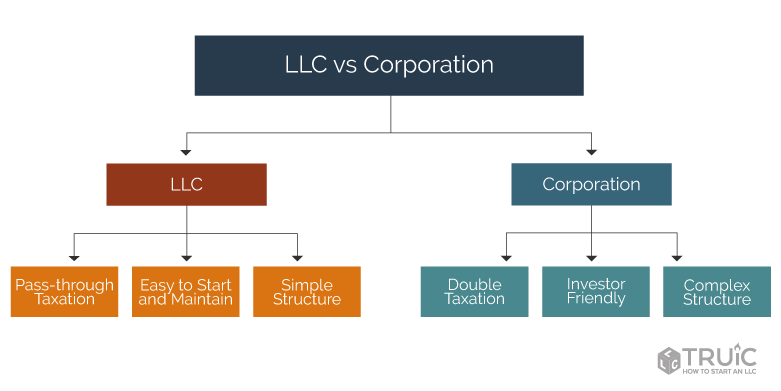

A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. They can choose to adopt the tax regime of sole proprietorships partnerships S corporations or C corporations.

A flow-through entity also known as a pass-through entity or fiscally-transparent entity is a legal business entity where its profits flow directly to the. This means that the business owner will be. 1 Is S corp a pass-through entity.

That is the income of the entity is treated as the income of the investors or owners. Structuring the admission of the service provider. However the late filing of 2021 FTE returns will be.

A flow-through entity FTE is a legal entity where income flows through to investors or owners. Types of flow-through entities. There are three main types of flow-through entities.

Using qualified S corporation subsidiaries and single-member LLCs. Flow-through entities are a common device used to avoid double taxation which happens wit See more. 2 Which is better LLC or sole proprietorship.

The protection of personal. A single member LLC is considered a disregarded entity for US. This means that when a company is unable to pay a debt the personal property of the LLC members such as homes and cars are shielded from the creditor.

A pass through entity is a type of legal entity where business revenues are passed through the entity to the business owner. An LLC that chooses to be taxed in this way will have its.

10 Tax Benefits Of C Corporations Guidant

Pass Through Entity Explained Perry Associates

How To File The Inventory Tax Credit Department Of Revenue

Strategic Entity Formation Cpa Financial Architects

California Llc Vs S Corp A Complete Guide Windes

Understanding Flow Through Entities Like S Corporations And Llc S Pace Accounting

Pass Through Entity Definition And Types To Know Quickbooks

Pass Through Entity Definition Examples Advantages Disadvantages

Pass Through Taxation What Small Business Owners Need To Know

Partnerships Or Llc Or S Corps Or C Corps Do You Need An Itin Being A Member Of This Entity Itincaa

9 Facts About Pass Through Businesses

Business Structure Choosing A Business Structure Truic

Business Structure Choosing A Business Structure Truic

9 Facts About Pass Through Businesses

Flow Through Entities Income Taxes 2018 2019 Youtube

Starting A Company Llc Vs Corporate Considerations Rubicon Law

Flow Through Entity Llc It Be Fun Bloggers Photo Galery

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax